Analyst Pushes Back on Steve Hanke’s Claim Bitcoin Lacks Value

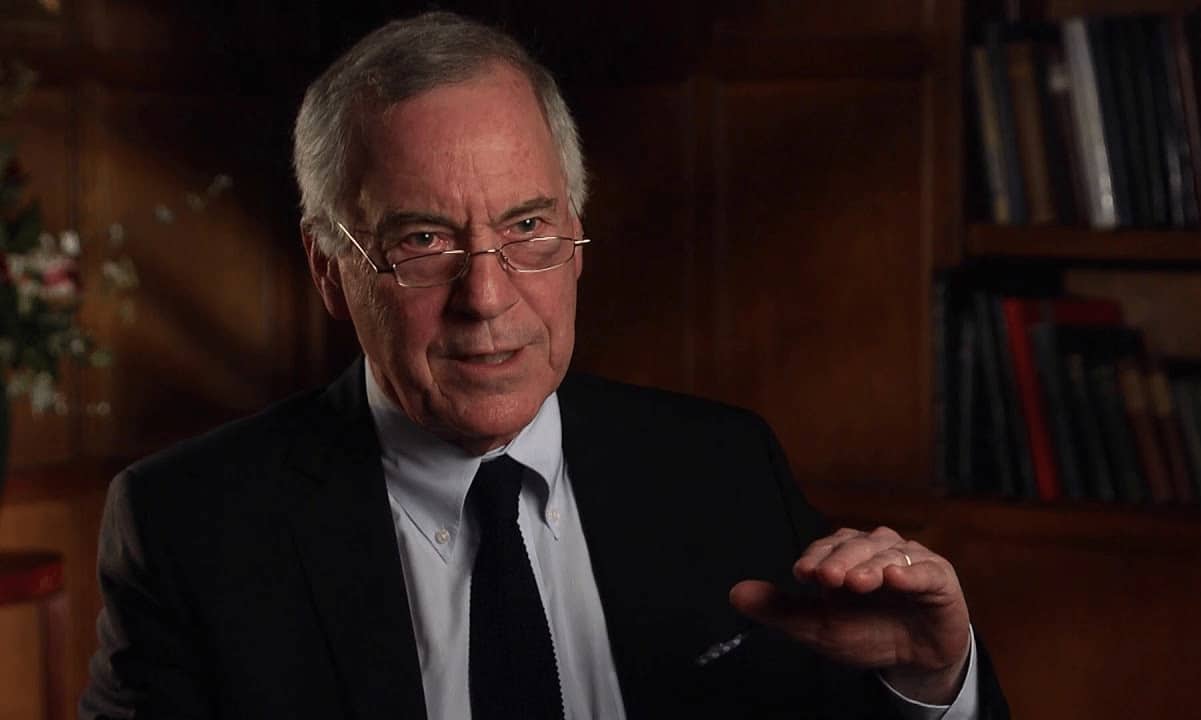

Bitcoin’s latest pullback has reignited a long-running argument over whether the asset has any real value, after economist Steve Hanke dismissed it as having “zero fundamental value” on X earlier today.

The comment landed during a volatile session that saw BTC dip toward the mid-$80,000 range, drawing sharp pushback from analysts and crypto figures who suggested that those judging the OG digital asset based on the market turmoil were missing the bigger picture.

Analysts Push Back as Bitcoin Slides Below $90K

Hanke, a Johns Hopkins professor, made his comments during a period of notable strain for cryptocurrencies. After several weeks of weakening from October peaks, Bitcoin’s price briefly hit a two-week low near $85,100 yesterday, according to market data.

“BITCOIN = A HIGHLY SPECULATIVE ASSET WITH ZERO FUNDAMENTAL VALUE,” the frequent crypto critic posted on X.

On-chain analyst Axel Adler Jr. was quick to react, calling Hanke’s assessment “absolutely incorrect” and arguing that Bitcoin is in a correction after years of growth and is transitioning into “a key element of the global financial system.”

Others framed the debate around trust and monetary history, with trader Carpe_Diem comparing the cryptocurrency’s supposed lack of value to fiat money, pointing to long-term loss of purchasing power in the U.S. dollar.

“Oh. You mean, like that fiat currency we call the US Dollar?” they asked, posting a chart showing the dollar’s 86% loss in purchasing power since 1972.

At the same time as the price drop, network data from December 9-14 showed a series of sharp daily drops in Bitcoin’s estimated hashrate, totaling drops of up to 12.8%. However, Adler cautioned that network metrics alone cannot confirm explanations for the occurrence circulating in the press, including reports of mining shutdowns in China.

Market Value, Macro Pressure, and the Bigger Debate

Price action has added weight to the argument on both sides. At the time of writing, Bitcoin was down around 3.4% over the past 24 hours as it continues to underperform its late-November highs near $100,000.

Ethereum slipped below $3,000 during the same window, while major altcoins such as XRP, Solana, and Cardano also posted short-term losses. The sell-off coincided with $210 million in liquidations within an hour, as reported by CryptoPotato, highlighting how leveraged positioning amplified the move.

Supporters argue that market value itself challenges the “zero value” claim. Swan Bitcoin quoted analyst Checkmate on December 15, noting that more than $1 trillion in capital has flowed into Bitcoin as a store of savings.

Commentator Daniel Tschinkel added that focusing only on price ignores Bitcoin’s global payment network and resistance to control.

Still, skeptics have pointed to tightening financial conditions and fragile technical levels, with some analysts now warning that delayed U.S. rate cuts could keep pressure on risk assets into early 2026, and the bearish scenarios could place BTC far lower before any sustained recovery.

For now, the clash between traditional economic theory and Bitcoin’s growing role in markets shows no sign of fading, especially when sharp drawdowns give critics fresh talking points.

The post Analyst Pushes Back on Steve Hanke’s Claim Bitcoin Lacks Value appeared first on CryptoPotato.