Descending Channel Keeps Pressure On As Buyers Defend $0.137

The post Descending Channel Keeps Pressure On As Buyers Defend $0.137 appeared on BitcoinEthereumNews.com.

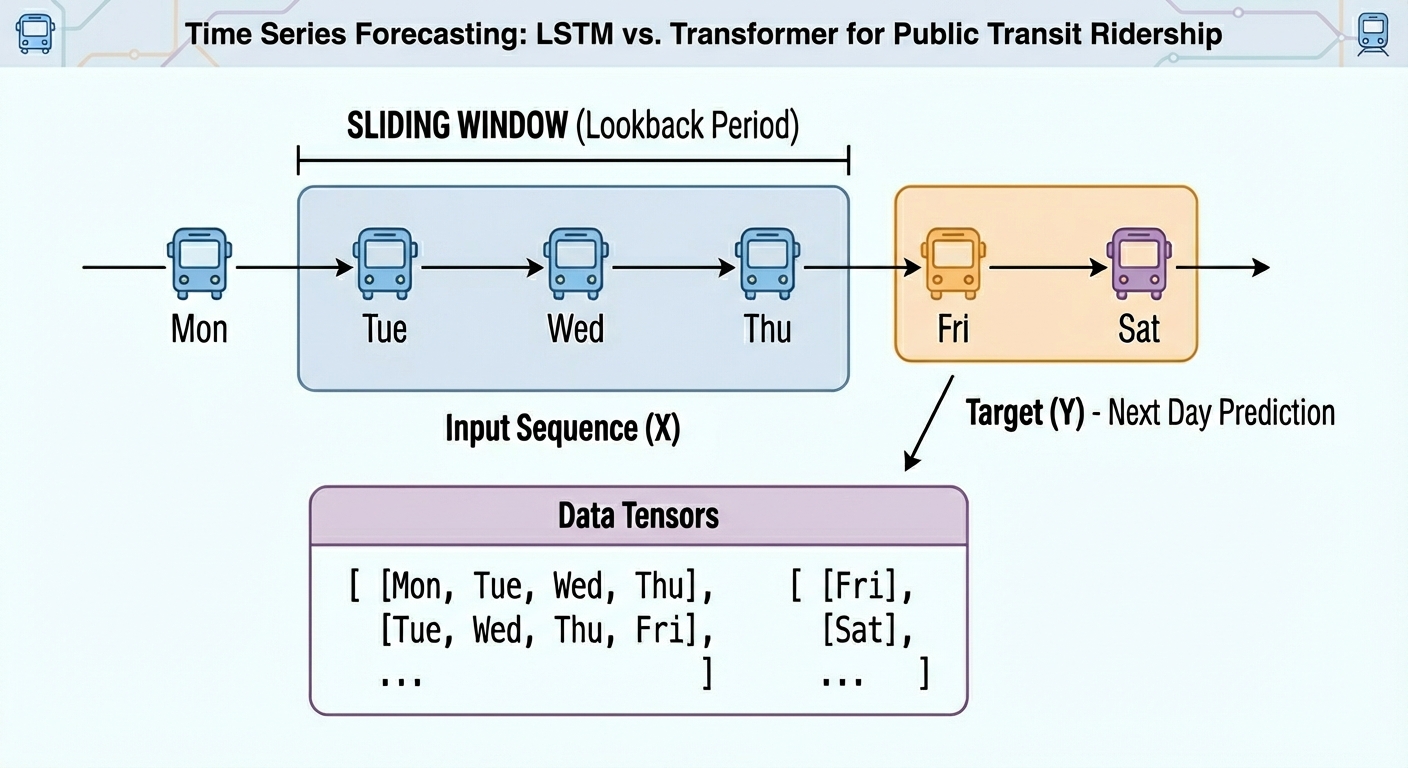

DOGE remains inside a descending channel, trading below all major EMAs as sellers fade every recovery attempt. Buyers are defending the $0.137 to $0.135 support zone, but intraday signals show stabilization, not accumulation. Broader risk-off sentiment and Bitcoin weakness continue to weigh on memecoins despite mixed on-chain signals. Dogecoin price today trades near $0.1367 after sliding steadily alongside Bitcoin as traders continue to pare risk exposure across the crypto market. The move leaves DOGE pinned near a key short-term support zone after last week’s breakdown, with sellers still controlling the broader structure while buyers attempt to stabilize momentum. Macro Shock Pushes Memecoins Into Defensive Mode The latest leg lower followed a macro-driven shift in sentiment after the Federal Reserve delivered a 25-basis-point rate cut. While the decision itself was expected, divisions among policymakers and renewed inflation concerns triggered a risk-off response across assets. Bitcoin’s slide below $90,000 over the weekend amplified pressure on high-beta segments of the market. Memecoins underperformed, with Dogecoin seeing accelerated selling despite the absence of DOGE-specific negative headlines. The move reflected positioning rather than fundamentals, as traders reduced exposure amid heightened volatility. That context matters. Dogecoin’s weakness is part of a broader de-risking cycle rather than an isolated breakdown. Trend Structure Remains Bearish On The Daily Chart DOGE Price Analysis (Source: TradingView) On the daily chart, DOGE continues to respect a clear descending structure that has guided price lower since the October peak near $0.31. Each recovery attempt over the past two months has failed beneath falling resistance, reinforcing seller control. Price remains below all major moving averages. The 20-day EMA sits near $0.144, followed by the 50-day EMA around $0.159. The 100-day and 200-day EMAs are far overhead at $0.179 and $0.194, respectively. This stacked EMA alignment keeps rallies capped and confirms a bearish medium-term…