SEC Meeting Reveals Diverse Views on Tokenization and DeFi Oversight

The post SEC Meeting Reveals Diverse Views on Tokenization and DeFi Oversight appeared on BitcoinEthereumNews.com.

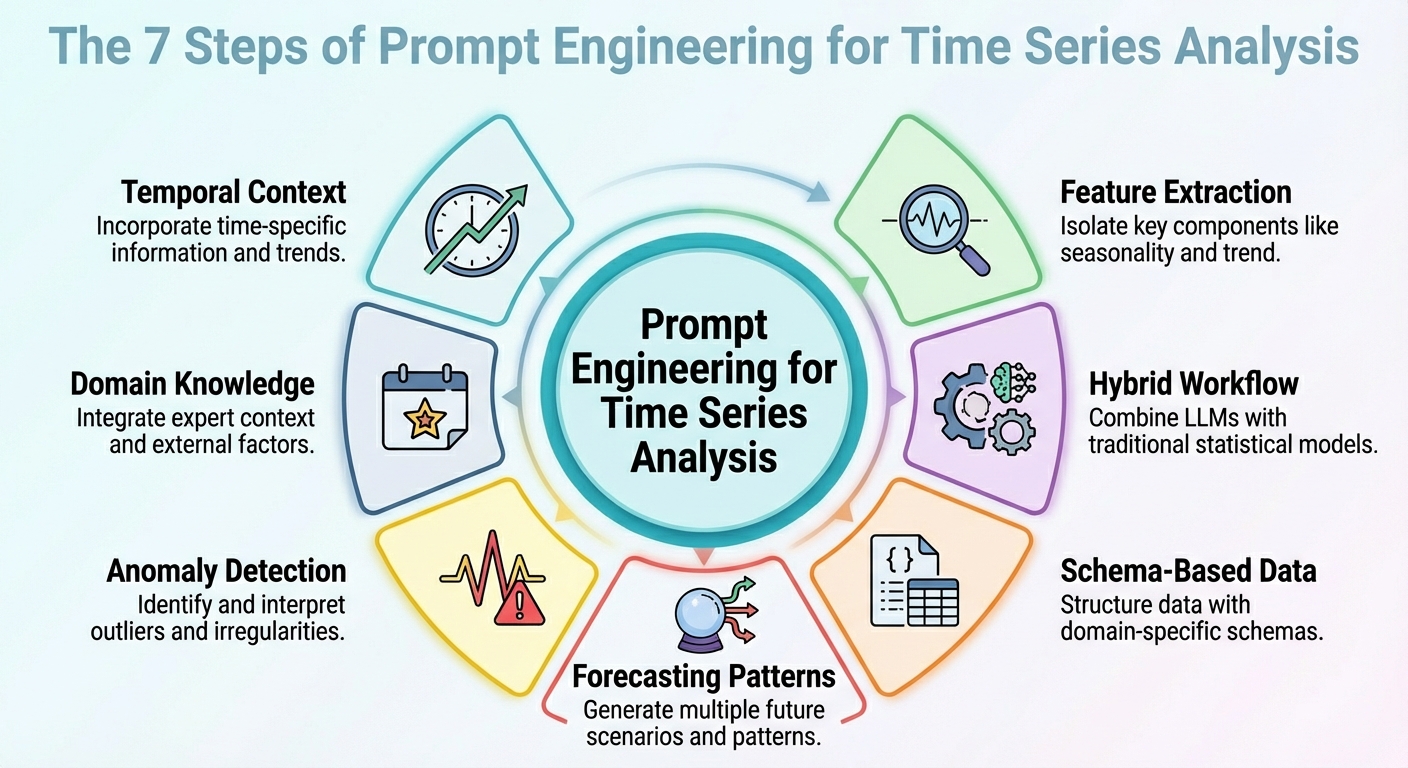

SEC Tokenization Regulation: Wall Street and Crypto Leaders Debate Oversight at Key Meeting In the recent SEC Investor Advisory Committee meeting on December 4, prominent Wall Street and crypto executives discussed effective regulatory approaches for tokenization and DeFi’s role. Tokenization, the process of digitizing real-world assets on blockchain, is surging in popularity, but experts urged a balanced, rule-by-rule framework to protect investors while fostering innovation. This 50-word overview highlights the need for clear SEC guidelines amid growing tokenized markets. Key Insight 1: Panelists from Citadel Securities, Coinbase, and Galaxy emphasized distinct paths for regulating tokenized assets, showcasing industry diversity in perspectives. Key Insight 2: Tokenization enables fractional ownership and faster trading of assets like real estate and equities, reducing intermediary dependencies. Key Insight 3: According to BlackRock’s Samara Cohen, the meeting revealed multiple solutions to current regulatory challenges, with over 70% of financial institutions exploring blockchain tokenization per industry reports. What is SEC Tokenization Regulation? SEC tokenization regulation refers to the Securities and Exchange Commission’s guidelines for overseeing the digital representation of assets on blockchain networks. This framework aims to ensure investor protection while enabling the benefits of tokenized securities, such as increased liquidity and transparency. As tokenization gains traction, the SEC seeks input on balancing innovation with compliance in decentralized environments. How Does DeFi Oversight Impact Tokenization? DeFi oversight involves regulating decentralized finance protocols that facilitate tokenized asset trading without traditional intermediaries. Experts like Jonah Platt from Citadel Securities argue for a rule-by-rule analysis to avoid broad exemptions that could expose investors to risks in the $100 billion+ DeFi market. Supporting data from regulatory filings shows that unclear rules have led to past compliance issues, while Scott Bauguess of Coinbase advocates adapting regulations to DeFi’s unique, intermediary-free structure. This targeted approach, as quoted by Platt, ensures the U.S. equity…