Strategy ($MSTR) Buys Nearly $1 Billion Worth of Bitcoin

Bitcoin Magazine

Strategy ($MSTR) Buys Nearly $1 Billion Worth of Bitcoin

Strategy, the largest publicly traded holder of bitcoin, said it acquired 10,624 BTC last week for about $962.7 million, returning to a scale of purchases not seen since mid-year as market volatility steadied.

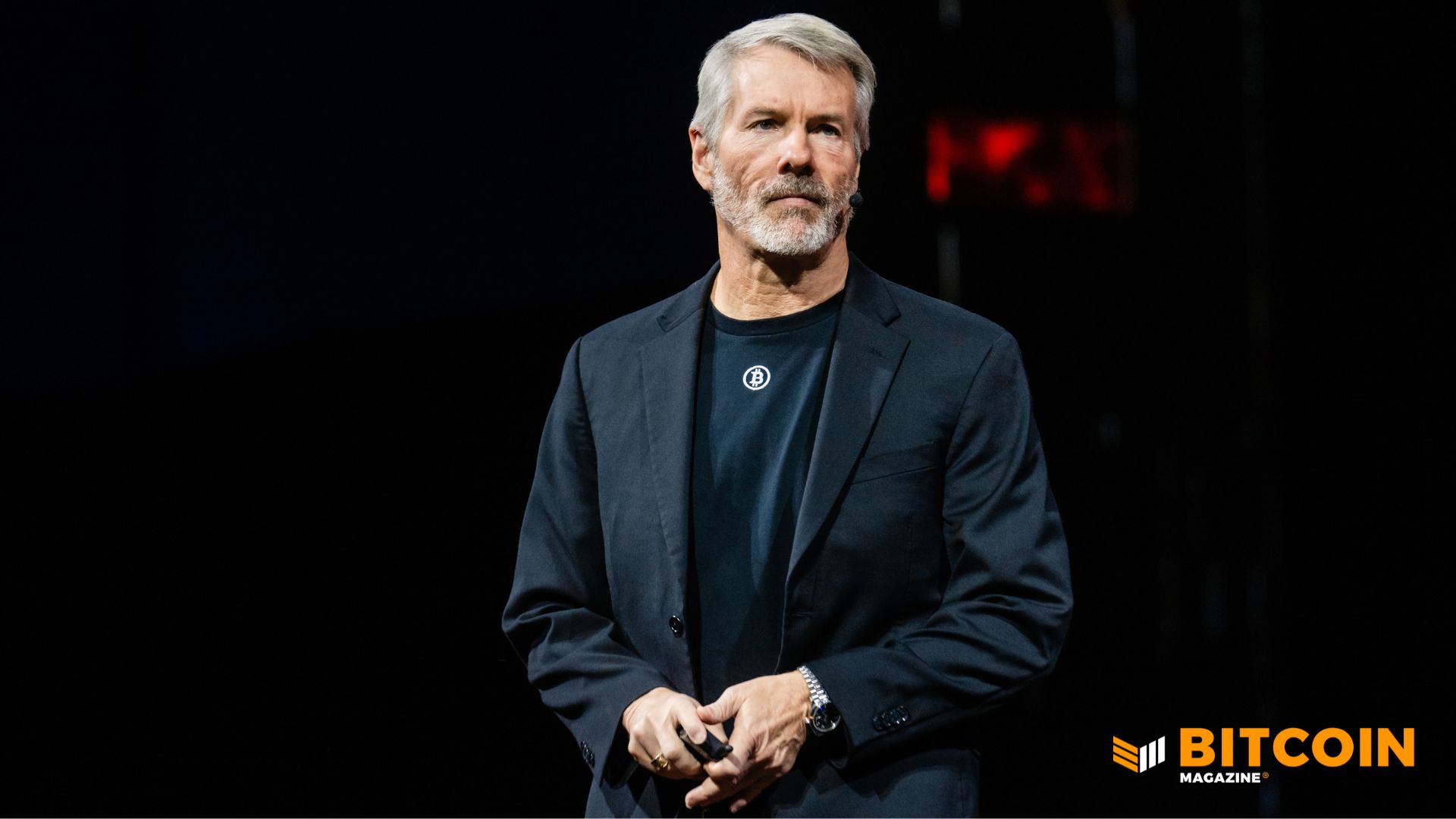

The company paid an average price of $90,615 per bitcoin during the Dec. 1–7 period, according to a regulatory filing and a statement from Executive Chairman Michael Saylor. The purchase lifts Strategy’s total bitcoin holdings to 660,624 coins, accumulated for roughly $49.35 billion at an average cost of $74,696 per bitcoin.

At current prices near $94,000, Strategy’s bitcoin stash is valued at about $60.5 billion, leaving the firm with an estimated $11 billion in unrealized gains.

Shares of Strategy (MSTR) were modestly higher in premarket trading Monday, rising about 2% alongside a small advance in bitcoin. The stock rebounded from a low near $155 on Dec. 1, reached during a sharp selloff across crypto-linked equities, but remains down more than 50% over the past six months.

Strategy’s largest purchase in 6 months

The acquisition marks Strategy’s largest weekly bitcoin purchase since July. In recent months, the company continued to add bitcoin almost every week, though in smaller amounts, as falling equity prices limited its ability to raise capital.

Last week’s transaction suggests improved access to funding, even as investor sentiment toward crypto-related stocks remains mixed.

Strategy said the purchase was funded primarily through its at-the-market equity sales program. The company raised $928.1 million from the sale of 5.13 million shares of MSTR common stock and an additional $34.9 million from selling 442,536 shares of its STRD preferred stock. Net proceeds totaled about $963 million.

The firm retains significant remaining issuance capacity across multiple securities. Strategy reported unused at-the-market capacity of about $13.45 billion in common stock and more than $26 billion across several preferred and structured offerings, including STRK, STRF, STRC, and STRD.

Saylor also highlighted the company’s “BTC Yield” metric, which he said reached 24.7% year-to-date in 2025. The measure is intended to reflect the growth in bitcoin held per diluted share, rather than changes in dollar value, and has become a core part of Strategy’s investor messaging as it positions itself as a bitcoin-focused treasury and structured finance business.

The latest purchase comes as Saylor attends the BTC Conference in Abu Dhabi. In public comments, he said he has spent the past week meeting with sovereign wealth funds, banks, family offices, and hedge funds across the Middle East to discuss bitcoin and capital markets. Strategy did not disclose whether those meetings resulted in any financing commitments.

You can listen to Mr. Saylor’s interview and other BTC Conference content on Bitcoin Magazine’s social media and YouTube.

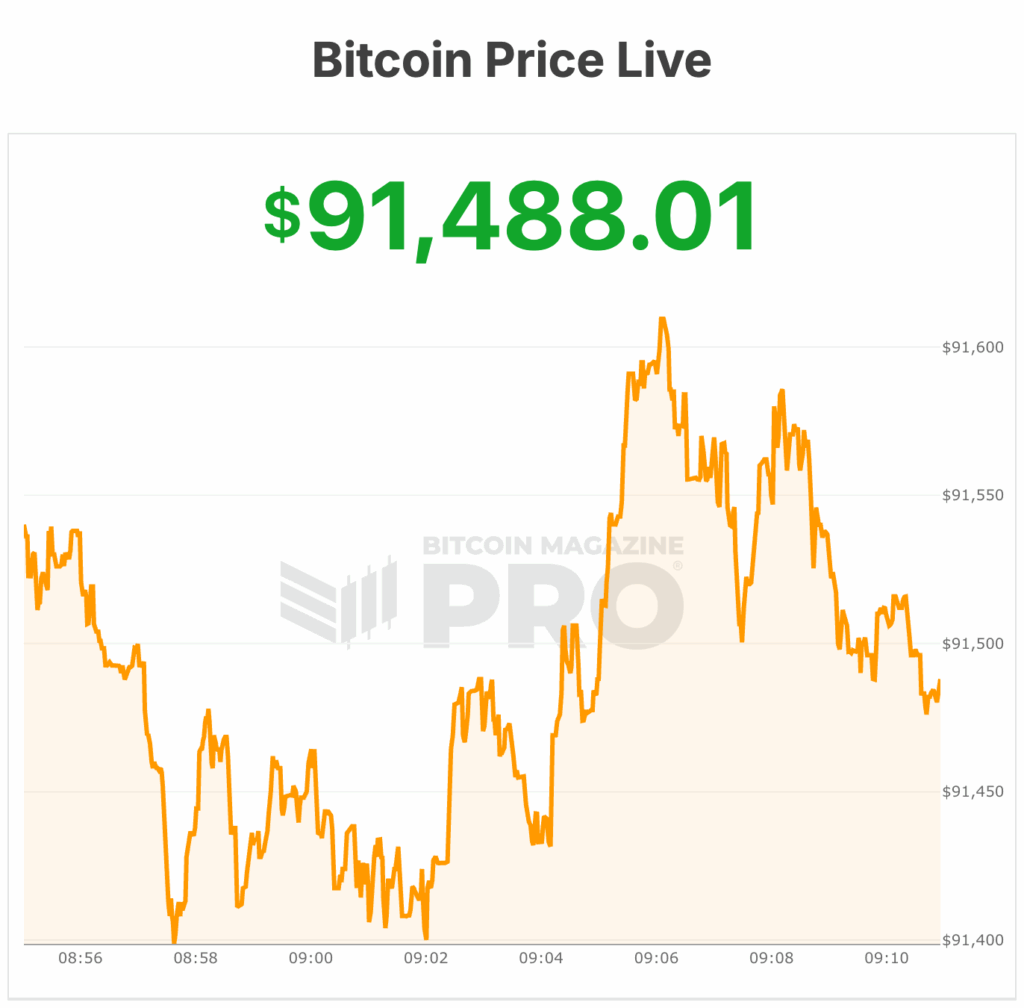

Bitcoin rose about 3% over the past 24 hours and roughly 1.5% on Monday morning, recovering from recent weakness that pushed prices into the low $80,000s. Some analysts attribute the bounce to expectations that the Federal Reserve may cut interest rates this week, which could support risk assets after the recent pullback.

The backdrop remains unsettled for Strategy. Investors continue to debate whether the company’s aggressive use of equity issuance to buy bitcoin amplifies both upside and downside for shareholders. The firm raised nearly $2 billion two weeks ago, largely to build a cash buffer to cover preferred dividend obligations, before tapping markets again last week to fund bitcoin purchases.

Strategy’s MSCI concerns

At the same time, Strategy faces uncertainty around index inclusion. MSCI is reviewing whether companies with large digital-asset holdings should remain in traditional equity benchmarks. JPMorgan analysts have warned that exclusion could trigger billions of dollars in passive outflows from Strategy if index funds are forced to sell.

Saylor has pushed back on those concerns, arguing that Strategy is an operating company with a sizable software business and a growing Bitcoin-backed credit operation, not a fund or trust. He has said index classification debates do not alter the firm’s long-term approach.

For now, the company is pressing ahead with that strategy. With more than 660,000 bitcoin on its balance sheet and continued access to capital markets, Strategy remains the most visible corporate proxy for bitcoin exposure in public equities, even as volatility in both crypto prices and its own shares shows little sign of fading.

The current bitcoin price is near $91,500.

This post Strategy ($MSTR) Buys Nearly $1 Billion Worth of Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.