What Past Says May Occur Next

The post What Past Says May Occur Next appeared on BitcoinEthereumNews.com.

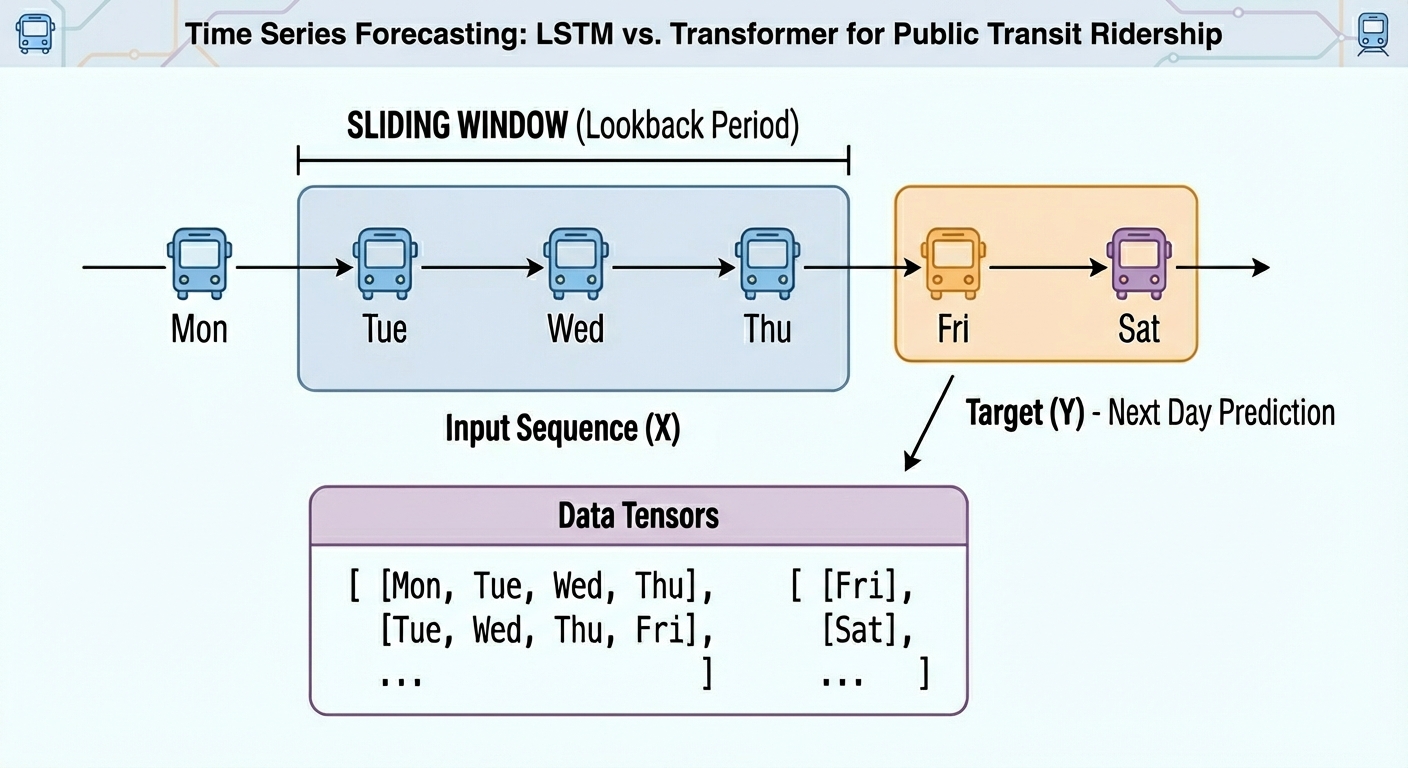

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure Data shows the Bitcoin Open Interest has seen a sharp drop recently. Here’s what this could lead to, according to historical trend. Bitcoin Open Interest Has Dropped 17% In Last Week As explained by CryptoQuant community analyst Maartunn in a new post on X, the 7-day change in the Open Interest has been significantly negative. The “Open Interest” here refers to an indicator that measures the total amount of positions related to Bitcoin that are currently open on all derivatives exchanges. When the value of this metric rises, it means the investors are opening up fresh positions on the market. Generally, new positions accompany more leverage, so the asset’s price can tend to become more volatile when this kind of trend develops. On the other hand, the indicator going down suggests the derivatives holders are either closing up positions of their own volition or getting liquidated by their platform. Such a trend can lead to calmer price action. Now, here is the chart shared by the analyst that shows the trend in the 7-day change of the Bitcoin Open Interest over the last couple of years: The value of the metric appears to have plunged in recent days | Source: @JA_Maartun on X As is visible in the above graph, the 7-day average of the Bitcoin Open Interest has dived into the negative zone recently, implying a large amount of positions have disappeared from the market in the past week. More specifically, the indicator has taken a hit of around 17.8% in this window. This massive drawdown in the metric has come as BTC’s recent volatility has triggered large liquidations in the market. In the chart, Maartunn has highlighted the instances where the sector saw deleveraging of…