Bitcoin whales and sharks double down on BTC accumulation as the asset closes June at $30,469

Bitcoin network’s whale and shark addresses, holding large volumes of BTC have consistently accumulated BTC over the past seven weeks. In the past two weeks, accumulation of Bitcoin picked up pace, as whales engaged in “buying the dip.”

Bitcoin network’s whale and shark addresses, holding large volumes of BTC have consistently accumulated the token over the past seven weeks. In the past two weeks, accumulation of Bitcoin picked up pace, as whales engaged in “buying the dip.”

BTC closed June at $30,469, the highest monthly close in the past thirteen months, fueling the thesis for a recovery in the asset in July.

Bitcoin whales accumulate BTC ahead of likely recovery

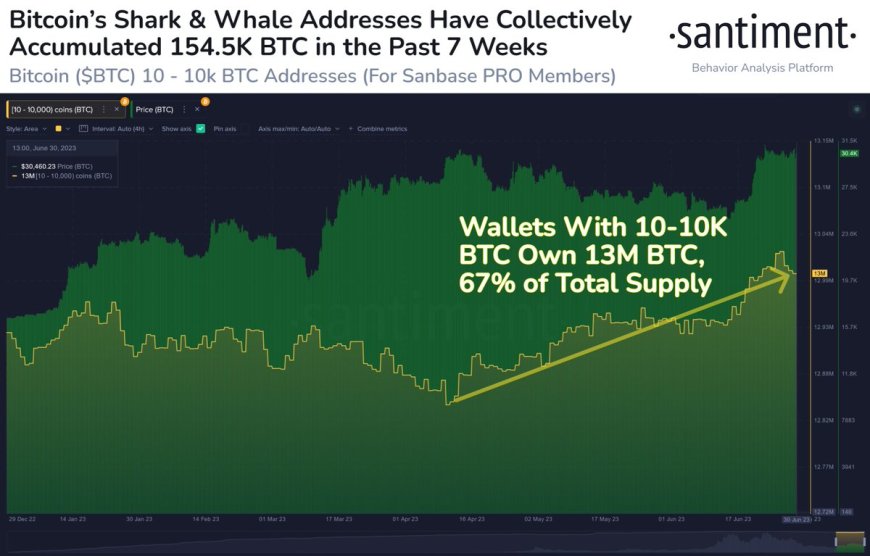

Based on data from crypto intelligence tracker Santiment, Bitcoin’s whale and shark addresses accumulated 154,500 BTC within a seven week period between April 2023 and the time of writing. Over the past two weeks, the pace of Bitcoin accumulation intensified.

Bitcoin whale accumulation

BTC whale wallets holding between 10 and 10,000 tokens now control 67% of the total supply of the asset.

This fuels a bullish thesis for the asset as whale holdings keep the selling pressure off the asset and increase potential for a recovery in Bitcoin price.

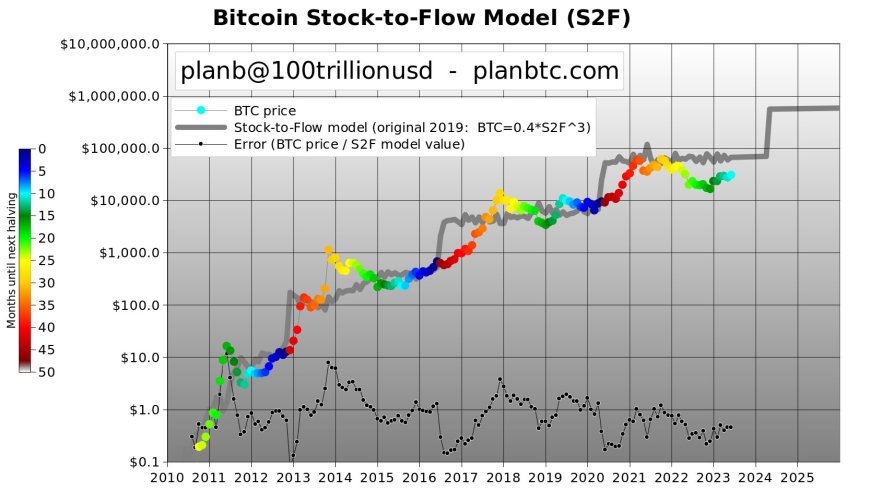

Bitcoin closes June at highest level seen in 13 months

Plan B, one of the largest Bitcoin influencers and analysts on crypto Twitter noted that Bitcoin closed June at $30,469. This is the highest monthly close that the asset has seen in thirteen months and it makes it likely that BTC begins its recovery in July and wipes out losses from June 2023.

Bitcoin highest monthly close in 13 months

For the last three years, Bitcoin has closed July profitable for holders. These factors make it likely that BTC price recovers from the SEC’s crackdown on crypto exchanges and regulation and makes a comeback.