GMX Crypto Whale In Danger Of Huge Liquidation if Ethereum Hits Price of $1,950

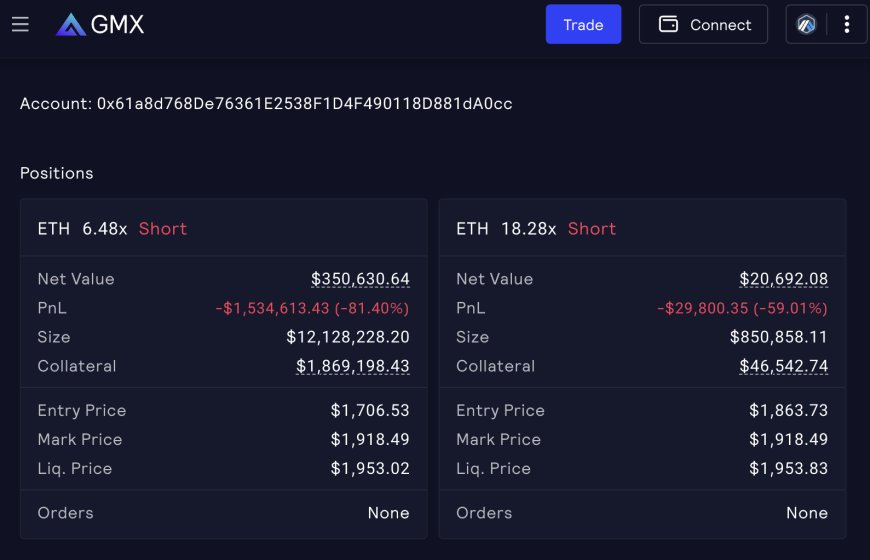

A GMX crypto whale that has been on an ETH shorting spree might be facing huge liquidation soon. The PnL data shows that he is in danger of losing 79.91% if the Ethereum price touches the $1950 mark.

A GMX crypto whale that has been on an ETH shorting spree might be facing huge liquidation soon.

The PnL data shows that he is in danger of losing 79.91% if the Ethereum price touches the $1950 mark.

Popular crypto Twitter influencer Taiki Maeda made his community aware of this situation via his tweet.

Let's track this $ETH shorter on $GMX together

On-chain positions create a social element to taking/monitoring positions, versus people just posting PnL after winning CEX trades. Never been a big fan of "copy-trade" platforms but might gain more traction If on-chain perps level… https://t.co/5XNds8jOBx

— Taiki Maeda (@TaikiMaeda2) June 23, 2023

Many crypto influencers on Twitter are asking, “why so many shorts” after witnessing via a chart that the GMX whale has shorted ETH 24 times from June 18th to June 22nd alone.

GMX Trader Can’t Stop Shorting

The GMX whale has implemented this strategy of shorting ETH in a way that no one can explain. Many are saying that he is implementing Delta Hedge. And others are countering that argument by saying that it would not be ideal to use GMX to implement this strategy.

What is Delta Hedge?

Delta Hedge is an options trading strategy that a trader implements to reduce or hedge the risk related to the price movements of an underlying asset.

One user has also stated that it is pretty “insane” that the whale has conditioned their orders to add all the way to their liquidity.

As you can see from this data, the liquidity price has been set at $1953. That is the reason many investors are wondering why the whale would take that position.

And some investors are being cheeky about it, saying that GMX bears are adding a margin to their already low position.

GMX Price Analysis

When it comes to GMX, the price of the asset has been stable above the $53 range since last month. The chart shows that mid-June was the only time that the token dropped in the red zones, crashing past the $45 mark.

But a quick rebound has allowed it to move past the $52.98 support. The current candle shows red signs. If GMX falls below its current support, it will try to stay above $50.

Currently, the token’s RSI is around 55 – keeping it a bit in the oversold zone. But GMX’s current stable trend doesn’t make it seem like it will drop any time soon.