Fidelity races BlackRock to a Bitcoin ETF — but Cathie Wood’s Ark is first in line

Fidelity became the latest finance giant to join the race for a spot Bitcoin ETF. However, Cathie Wood’s Ark Invest might win an SEC nod first.

Fidelity joined a crowded field hoping to gain approval for a spot Bitcoin exchange-traded fund this week, but Cathie Wood’s Ark Invest is first in line.

Ark Invest amended its latest application to include a surveillance-sharing agreement with the CBOE, the world’s largest options exchange, and an unnamed crypto exchange on June 28.

Ark is in a “pole position to be approved first because they filed first,” according to Bloomberg Intelligence ETF analyst Eric Balchunas.

Ark refiled its application with 21Shares on May 9, with an answer expected between August 13 and the beginning of October, per Bloomberg data.

BlackRock’s application included a similar agreement, with the Nasdaq as the partner.

Wood’s fund has been an early backer of Bitcoin and cryptocurrency technology. Ark ETFs hold Coinbase and Block shares and forecast Bitcoin could hit $1 million by 2030.

Fidelity’s application follows similar filings from BlackRock, WisdomTree and Valkyrie. The flurry comes as more financial giants seek to widen their crypto offerings. Big banks and asset managers are on a hiring spree in digital assets amid projects in trading, payments and tokenisation.

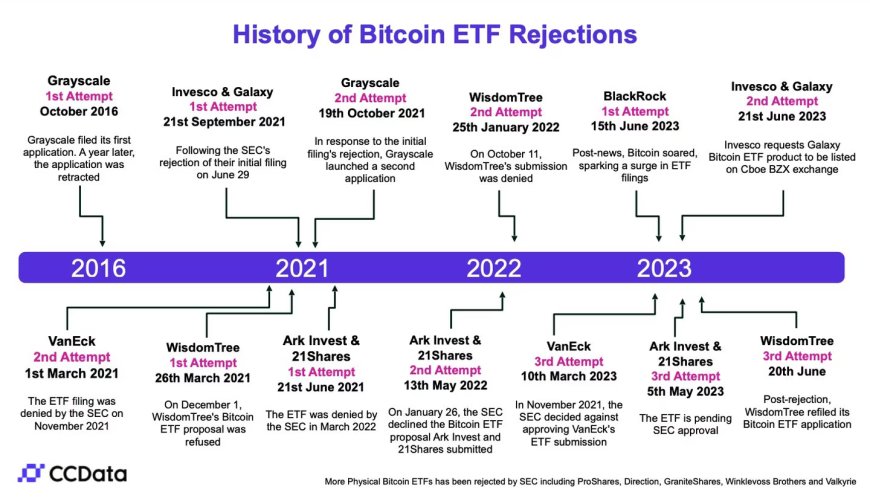

The Securities and Exchange Commission rejected Fidelity’s last application in early 2022. However, Fidelity getting approval is not a foregone conclusion. The past seven years have been full of SEC rejections.

Back in 2016, Grayscale’s first attempt to get a Bitcoin ETF approved was retracted. Five years later, VanEck’s second attempt for a fund was rejected by the SEC.

In the following years, WisdomTree, Invesco & Galaxy and Ark Invest all had their applications rejected.

ETF frenzy

BlackRock’s June 15 application kicked other firms into gear. The surprise application from Larry Fink’s firm was followed by WisdomTree and Valkyrie filing similar applications.

Bitcoin has been buoyed by the news, with investors piling into the leading cryptocurrency by market capitalisation. It is now up roughly 20% since BlackRock’s application, according to TradingView data. Bitcoin is set to close the quarter up just under 6%.

It’s not just Bitcoin that has benefited from the latest round of applications. Crypto native from Grayscale has seen its flagship product, the Grayscale Bitcoin Trust, jump in price this month.

Shares in the trust are up around 39%, trading at $19.55, according to TradingView data.

Grayscale is waiting for a ruling following oral arguments in a case against the SEC for rejecting its proposal to convert its trust into a spot Bitcoin ETF. A response is expected by September, although it could come imminently.