Nearly 80% Of Ethereum Staking Rewards Withdrawn, Research Firm Reveals

In September 2022, Ethereum finally switched towards a Proof-of-Stake (PoS) consensus mechanism. In such a system, a consensus is met on the blockchain through stakers and not miners

1.5 Million ETH In Total Has Been Withdrawn Since Ethereum Shanghai Upgrade

In September 2022, Ethereum finally switched towards a Proof-of-Stake (PoS) consensus mechanism. In such a system, a consensus is met on the blockchain through stakers and not miners

Anyone can become a staker if they deposit 32 ETH into the staking contract. While the mainnet only transitioned to the PoS system in September 2022, as mentioned earlier, the staking contract had already been live on a test blockchain since November 2020.

This means holders have been depositing into the contract and earning staking rewards since then. However, until the recent Shanghai upgrade, there was a limitation attached to this contract all those years.

While the deposit functionality was in place, the investors couldn’t yet withdraw their coins from the contract. Because of this reason, a large number of rewards had amassed with the validators while this restriction remained.

The Shanghai upgrade launched just earlier in the month allowed the investors to withdraw their locked ETH and staking rewards. Since the rewards had piled up on the contract all these years, it was expected that many withdrawals would occur when the upgrade was in place.

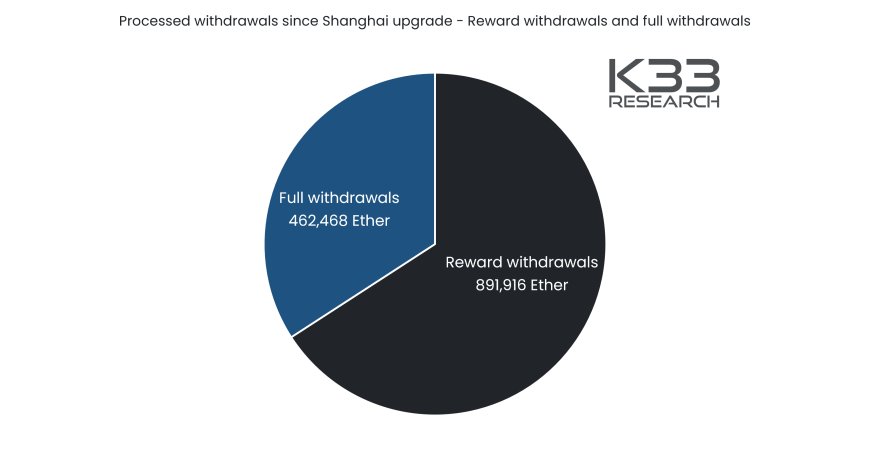

According to a new post from K33 Research (formerly Arcane Research), nearly 1.5 million ETH ($2.8 billion) has been withdrawn since 12 April 2023, when the hard fork occurred. The pie chart below shows these withdrawals’ division between full and reward-only ones.

The withdrawals that have taken place since the Shanghai upgrade | Source: K33 Research

The “full withdrawals” here refer to withdrawals involving the complete exit of the 32 ETH stack that the validator had to put into the staking contract at the beginning (this means that after this kind of withdrawal, the investor no longer remains a validator).

Only about one-third of the total withdrawals were of this type (around 462,468 ETH); the other two-thirds involved only the exit of the staking rewards (891,916 ETH).

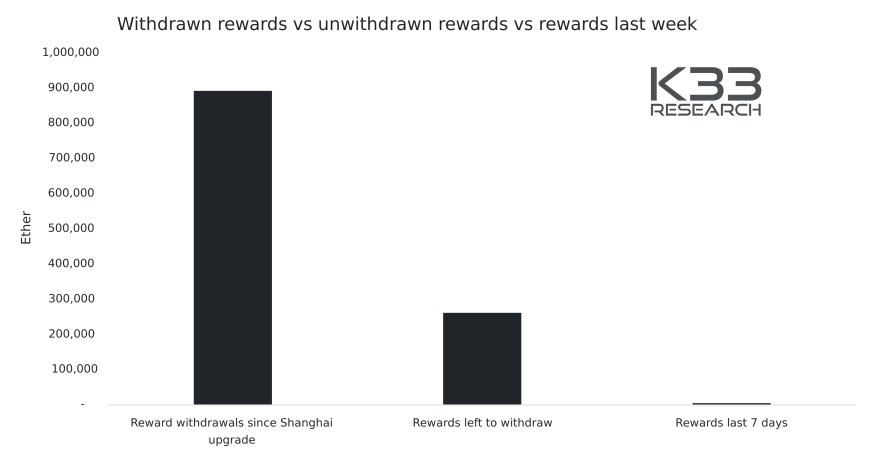

Now, here is a chart that breaks down how these reward withdrawals that have taken place since Shanghai compare with the accumulated rewards yet to be touched:

Looks like a majority of the rewards have already been withdrawn | Source: K33 Research

As displayed in the above graph, the Ethereum staking rewards that have been withdrawn since the Shanghai upgrade has gone live far outweigh those that are still being taken out. More precisely, around 80% of the total rewards accumulated prior to the hard fork have already been withdrawn.

From the chart, it’s also apparent that the rewards amassed within the last seven days have been minuscule compared to those previously accumulated.

This would suggest that any extraordinary selling pressure coming into the market since the start of these withdrawals should already be almost entirely exhausted. The same pressure wouldn’t be kept up in the future due to the slow pace of new rewards being distributed among Ethereum validators.

ETH Price

At the time of writing, Ethereum is trading around $1,800, down 8% in the last week.

ETH has plummeted recently | Source: ETHUSD on TradingView